My Two Cents - "The End of Summer Days"

10/13/2006

As the leaves begin to turn yellow, the sun sets a little earlier in the day, and the nights turn cooler, I am reminded all too often of the obscure Tyketto song entitled "The End of Summer Days". This melancholy ballad describes the end of a summer to top all summers, the best of times, and the slow transition from summer's boom to winter's bust. There is another winter moniker that I've heard mentioned quite a bit lately: the Kondratieff winter. Obviously, this deserves some preamble and explanation, so please bear with me.

From time to time you'll hear people on financial shows talk about technical analysis. These people are often referred to as 'chartists' or chart-watchers. They feel that there are certain patterns that when played out tend to predict future price behavior. The single component of all of these schools of thought whether they base themselves on Elliott waves, K-waves, Fibonacci series or other types of cycles or patterns is that all of the methodologies are rearward looking. Kondratieff waves are no exception.

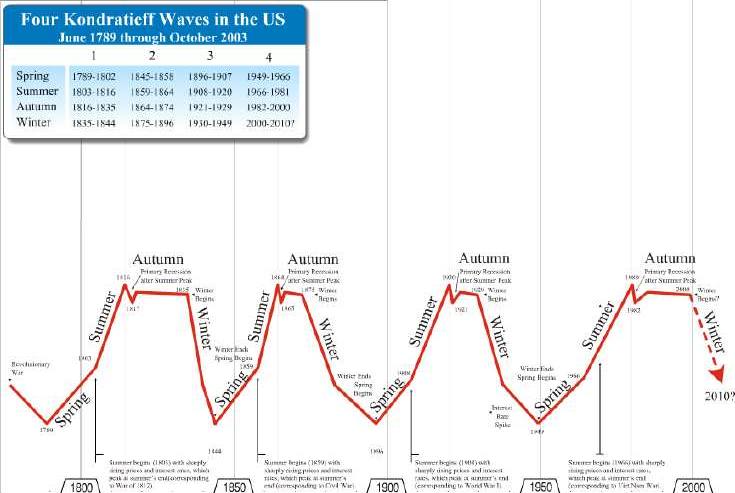

Nikolai Kondratieff, a Russian economist, wrote of a natural business cycle that occurs in capitalistic countries. His work was conducted largely in the early 20th century and encompassed the major business cycles on a global scale since 1789. He observed a cyclical pattern in the behavior of prices, interest rates, taxes and other components of macroeconomic function. The thing that struck me with regard to K-waves is the seemingly reproducible pattern that has emerged over the past 200 years. Of course that is no guarantee that we'll have another K-winter, but I'd say the chances are pretty good. In fact I think we're already there.

K-waves are purported to be truly aggregate in nature, reflecting conditions on a macro level rather than specific countries or industries. For example, K-waves are not a terribly good indicator for predicting the changes in GDP for the United States from month to month. The waves are output-oriented, as opposed to price-centered, so the relationship between the waves and prices is implicit rather than explicit. It is important to note that much like a wave in the ocean there is a peak, a trough, and a frequency (the distance between peaks). The chart shown below depicts K-waves in the United States since 1789:

Hence my opening analogy with the 'End of Summer Days' and the beginning of a Kondratieff winter. So what does this mean? A K-winter is a period of rapidly rising prices, lower output and a general contraction of the economy, complete with a flushing of debt. Certainly we've had other winters and survived them all. We know that because the next generation made it to this point. The problem lies in the fact that we're entering this winter so grossly unprepared. We've survived other winters by falling back on our savings, curtailing expenses and enduring. I am not at all convinced that the character of America in the 21st century is capable of achieving such feats.

If one were to rely solely on the chart, one could conclude that we've been in a K-winter since 2000. With all the recent boom in real-estate, I think you'd be hard pressed to convince anyone that things have been really 'bad'. On the other hand, all one has to do is point to the financial calisthenics that have been conducted to postpone this winter. One thing is clear: previous cycles were allowed to run their course in some way, shape, or form. Much effort has gone into pushing this cycle off to some point in the future. It's tantamount to the government putting heaters outside to keep the air warm in the middle of January.

There are several questions here which I pose as food for thought and discussion:

1) Should any credence be given to Kondratieff cycles?

2) If there truly is an order to economic cycles, what will the cost be for disrupting that order?

3) As a consumer-investor, what (if anything) can I do assuming Kondratieff cycles are accurate?

I will be the first to admit that commentators, myself included, have a tendency to be dogmatic in that we cling to theses and data that validate our positions and discard those that do not. I certainly agree with Kondratieff and others that there appears to be a cyclical pattern with regard to economies, especially on a global scale. As far as using K-waves as a prognosticator for future ups and downs, I'm still on the fence. Truly, by the time we can be sure of anything, the theory will have had to either validate or disprove itself; in either case, the time for action will long have passed (see last week's commentary).

So as you begin to peruse the mountains of financial information available to you, the next time you hear the term Kondratieff Winter you'll be able to point to a well-worn coat and be reminded of that obscure song, 'The End of Summer Days'.

Until Next Time,

Graham Mehl is a pseudonym. He is not an ‘insider’. He is required to use a pseudonym by the policies of his firm when releasing written work for public consumption. Although not an insider, he is astonishingly bright, having received an MBA with highest honors from the Wharton Business School at the University of Pennsylvania. He has also worked as an analyst for hedge funds and one G7 level central bank.

Andy Sutton is a research and freelance Economist. He received international honors for his work in economics at the graduate level and currently teaches high school business. Among his current research work is identifying the line in the sand where economies crumble due to extraneous debt through the use of economic modelling. His focus is also educating young people about the science of Economics using an evidence-based approach.