My Two Cents - "Triple-A or Bust?"

05/22/2009

If you take a short walk down memory lane, it will not take you very long to find the carcass of New Century Financial along the side of the road back in March 2007. It would be a full 12 months before the word recession would be mentioned in the US mainstream media and stock markets would roar into their all-time highs six months after the disintegration of New Century. Much of the early portion of the credit crisis as it was called focused on mortgages and after that, mortgage-backed securities. Wow, haven’t heard that term in a while, have we?

Much of the scuttlebutt at the time centered around the ratings which were assigned to these mortgage bonds and people started asking questions about how all of these Triple-A rated bonds could suddenly be worthless and why bonds with this high of a rating were paying historic spreads above and beyond US government debt of the same maturities (which are also rated Triple-A).

An Example of the spread between Triple-A rated securities

Of course the foundations for this comparison in the first place are the quality and status of US government debt, which, until recently, was sacrosanct in borrowing circles. In the past week there have been headlines galore (again) that the US is in jeopardy of losing its Triple-A credit rating. Given what we already know about the government’s finances, how can a pristine credit rating and Uncle Sam be mentioned in the same sentence? And perhaps more importantly, can ratings issued by the major agencies be worth more than a defaulted mortgage tranche after the ratings fiasco of the past few years? Consider the following:

“According to the Financial Times report, "Internal Moody’s documents seen by the FT show that some senior staff within the credit agency knew early in 2007 that products rated the previous year had received top-notch Triple-A ratings and that, after a computer coding error was corrected, their ratings should have been up to four notches lower." Yet the ratings were maintained at Triple-A.”

So why the big todo about the US Government and its Triple-A rating? The point is it shouldn’t have one to begin with. While I am sure this statement doesn’t constitute a revelation to anyone, it is a point that most in the main stream media are once again missing. Some big names have lost Triple-A credit ratings over the past few months. General Electric and the venerable Berkshire Hathaway are two notable examples. AIG lost its Triple-A rating in 2005, and bond insurer Ambac lost its Triple-A rating in 2008.

In the case of normal businesses, the credit rating is a reflection of the firm’s financial position and the market forces that are likely to impact the firm over various periods of time. The firm’s balance sheet is examined. Its revenues and obligations are dissected. The credit rating is then assigned based on the preponderance of these factors and indicates to investors the likelihood of default on the firm’s debt. Investors are then able to make informed decisions. At least this is how it is supposed to work.

Moody’s / S&P Default Probability Models

However, there is one major difference between a normal business and the US Government. Unlike a normal business enterprise, the US Government has a bank on retainer that can create money from nothing and is willing to lend at ridiculously low rates. It can accomplish this task in many ways, but the most direct is called monetization, which consists of the Fed buying bond issues directly from the government. Ostensibly, this is done to prevent the government from having to fund its massive appetite for funds externally. As if there is something honorable about owing your future to a private bank as opposed to another sovereign nation. Further evidence of the Fed’s willingness to monetize additional debt emerged this week:

“Some members noted that a further increase in the total amount of purchases might well be warranted at some point to spur a more rapid pace of recovery.”

Is an entity that requires this type of arrangement for its financial survival deserving of the highest credit rating? How about an entity that is going to have to borrow 46 cents for every dollar it spends during FY 2009? How about an entity that is institutionalizing trillion dollar deficits for the next decade? How about an entity that has a bare minimum of $53 Trillion in contingent unfunded liabilities (nearly four times GDP)?

After this most recent bevy of news headlines regarding the rating situation, Treasury Secy. Tim Geithner promptly got on TV to talk about cutting the budget deficits.

“It’s very important that this Congress and this president put in place policies that will bring those deficits down to a sustainable level over the medium term,” He added that the target is reducing the gap to about 3 percent of gross domestic product, from a projected 12.9 percent this year.

Putting this in the context of our current situation, this would require the deficit to be cut from a projected $1.8 Trillion to just $418 Billion – which is where it was before the current blowout. This is an important distinction as promises by government officials to actually balance the budget are fading quickly into the ether. Now we’re only worried about carrying ‘sustainable’ debt. The problem is that none of these debts are ever paid back and as such, they accumulate all the while piling on interest.

In order to pay off our debt, not only would we have to stop running deficits, we’d actually have to run surpluses. If we ran could manage a surplus that was 3% of GDP each year, it would take us over 30 years to pay off what we already owe on the national debt. That is three decades of smaller government, bare essential expenditures, and the complete dissolution of the ‘cradle to grave’ mentality our government has espoused for the last half century.

Geithner, 47, also said that the rise in yields on Treasury securities this year “is a sign that things are improving” and that “there is a little less acute concern about the depth of the recession.”

This is nothing more than just economic pumping. What the rise in yields is really saying is that when the Fed doesn’t step in and buy US Government bonds that nobody else wants them either. Why would any sane individual lend to somebody that is up to their eyeballs in debt and isn’t even the least bit interested in changing their behavior? To make matters worse, why would any sane individual lend to an entity that proposes to repay the loan in currency that is losing its value?

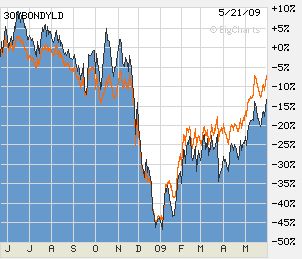

30-Year Bond Yields

In the above chart, we can see the yield for the 30-year bond. The Fed began indirectly monetizing in the fall of 2008 as the proceeds of TAF, TSLF, etc. went directly to the Treasury window driving yields to nothing. Another spurt of direct Fed monetization in March led to a quick drop in yields, but since then they have been moving relentlessly higher. Foreigners have not stopped buying US Treasuries by any means, but they have certainly slowed their purchases. This leaves the Fed as the buyer of last resort. Certainly Secy. Geithner understands all this, especially considering he used to be the President of the NY Federal Reserve Bank.

Does any of the above sound financially virtuous and deserving of a pristine credit rating? In the end it matters not what Moody’s or S&P have to say about the creditworthiness of the US Government. Our creditors are already speaking. And they aren’t singing our praises.

In our ‘Spin Cycle’ podcast, we are currently doing a 7-part series in which we depict the factors affecting the US economy as sides of a Rubik’s Cube – independent, yet interrelated. On June 3rd, we welcome Professor Laurence Kotlikoff to discuss generational accounting and our mounting debt. To listen, visit www.my2centsonline.com/radioshow.php

Until Next Time,

Graham Mehl is a pseudonym. He is not an ‘insider’. He is required to use a pseudonym by the policies of his firm when releasing written work for public consumption. Although not an insider, he is astonishingly bright, having received an MBA with highest honors from the Wharton Business School at the University of Pennsylvania. He has also worked as an analyst for hedge funds and one G7 level central bank.

Andy Sutton is a research and freelance Economist. He received international honors for his work in economics at the graduate level and currently teaches high school business. Among his current research work is identifying the line in the sand where economies crumble due to extraneous debt through the use of economic modelling. His focus is also educating young people about the science of Economics using an evidence-based approach.